We risk another 2008-style crisis. Is that really preferable to 3%-4% inflation for a year or two longer than we’d like? Even that is a false choice – ignoring all the other tools we have to fight inflation (that don’t involve crippling the world’s financial system).

So why do so many people want the Fed to keep on yanking that lever – risk be damned?!? I keep seeing public figures calling for the Fed to stay the course. It is plain as day that we risk tipping the financial system over into a 2008 style financial crisis if we press too hard for too long. Is that a risk worth taking?

Am I confidently predicting a crisis? No. Why? Financial crises aren’t predictable! Who expected really expected to spend last weekend brushing up on the mechanics of a classic George Bailey “Its a Wonderful Life” bank run?

I am confidently predicting that the Fed pointlessly and exponentially increases the risk of a financial crisis the longer they keep the yield curve inverted (short-term rates higher than long-term rates). It doesn’t matter how much they hike next week. What matters is how long they keep rates at the current (or higher) level. The longer we stay where we are, the higher the risk of a crisis.

The Silicon Valley Bank fiasco was one warning. Credit Suisse’s blow-up a few days later was another warning. Blackstone closing the exits to its BREIT Real Estate fund a few months ago was another.

What I have not seen is a convincing argument for “We should risk a 2008-style mega crisis – keeping the yield curve inverted – in order to prevent a greater threat.” “Inflation!!!” is the cited threat? But is that really such a big deal?

Inflation is also NOT AN OBVIOUS CRISIS! Look at these links to various Federal Reserve measures of inflation expectations. Nothing here says “we should risk a bank crisis to avoid the horrible fate foretold here” IMHO

- https://www.newyorkfed.org/microeconomics/sce#/inflexp-3

- https://fred.stlouisfed.org/series/T5YIFR

- https://www.clevelandfed.org/indicators-and-data/inflation-expectations

From a newsletter I subscribe to.

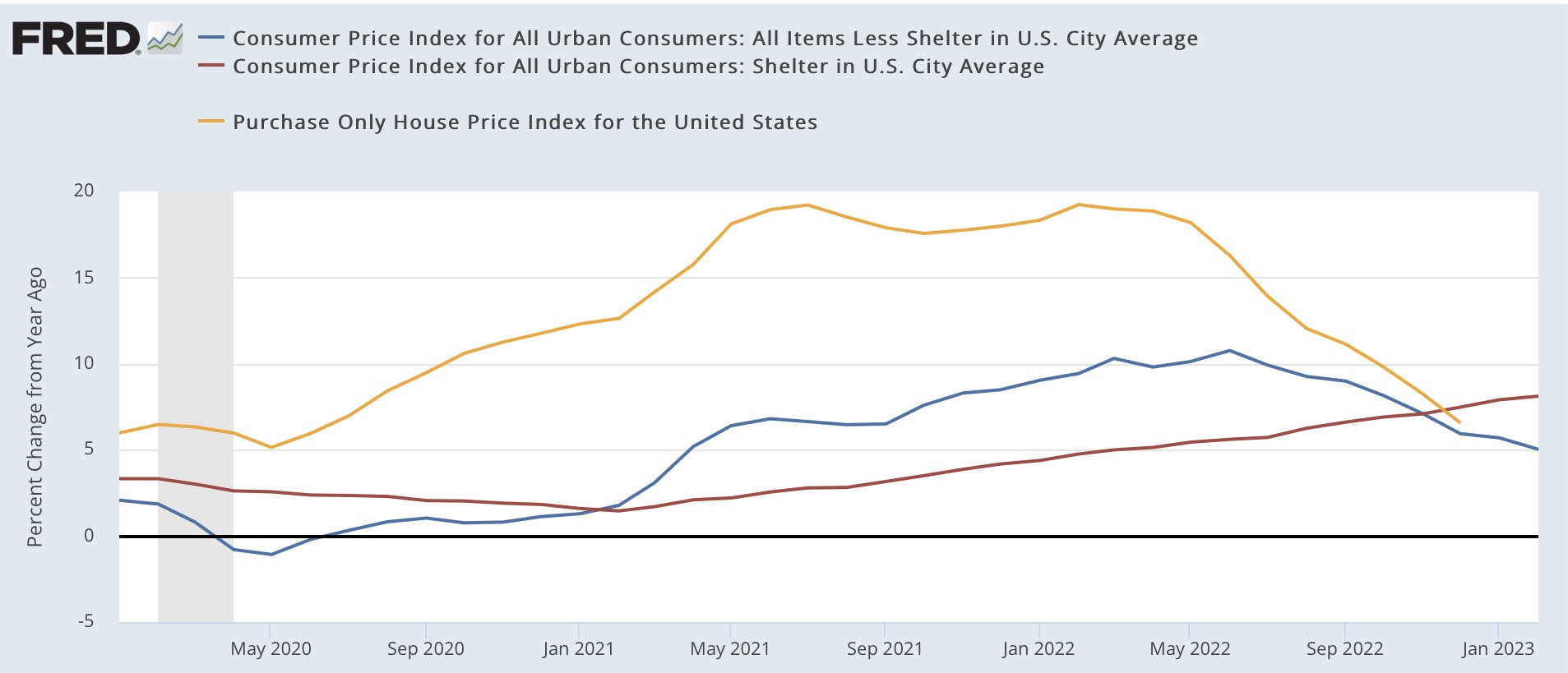

“New Deal democrat argued that “Properly measured, consumer prices have been in deflation since last June “. He highlighted the lagging nature of Owners’ Equivalent Rent (OER), the major component of shelter CPI, as house prices tend to lead OER by 12 months or more. After making all the adjustments, NDD concluded: If we substitute the FHFA house price index for OER, headline CPI would have been down -1.4% as of December (since that is when the reported FHFA data ends).”

Current inflation is also driven mostly by real economy supply demand dynamics. The inflation solution must also come from supply/demand. With the price mechanism (“inflation”) doing that balancing with time and patience. The level of short-term interest rates is, in that equation, not a particularly decisive factor. The non-impact of 4.5 points of rate increases would seem to be evidence enough by now?